Embark on a journey into the realm of Sustainable Life Coverage with Long-Term Benefits, where financial security meets sustainability in the insurance industry. Discover the key elements that make this type of coverage unique and essential for long-term planning.

Understanding Sustainable Life Coverage

In the insurance industry, sustainable life coverage refers to a type of life insurance policy that not only provides financial protection for beneficiaries in the event of the policyholder's death but also offers long-term benefits that promote the overall well-being and financial security of the insured individual during their lifetime.

Long-term benefits in life insurance policies are crucial as they ensure that the policyholder receives additional value beyond just a death benefit. These benefits can include cash value accumulation, potential dividends, and other features that can help the insured individual build wealth, supplement retirement income, or cover other financial needs.

Comparison with Traditional Life Insurance

- Sustainable life coverage typically offers more flexibility and options for policyholders to customize their coverage based on their financial goals and needs, whereas traditional life insurance policies may have more rigid structures.

- Long-term benefits in sustainable life coverage can help policyholders address financial challenges during their lifetime, such as funding education expenses, purchasing a home, or starting a business, in addition to providing a death benefit.

- Traditional life insurance policies may focus primarily on providing a lump sum death benefit to beneficiaries without offering as many opportunities for policyholders to access cash value or additional benefits while they are alive.

Benefits of Sustainable Life Coverage

Having long-term benefits in life insurance can provide policyholders and their families with financial security and peace of mind for the future.

Financial Security

- Long-term benefits in sustainable life coverage ensure that policyholders have a safety net in place for unexpected events such as accidents, illnesses, or death.

- Policyholders can rest assured knowing that their loved ones will be taken care of financially in the event of their passing.

Support for Long-Term Financial Goals

- Sustainable life coverage can help policyholders achieve their long-term financial goals such as saving for retirement, funding their children's education, or building wealth over time.

- By providing a reliable source of income and financial protection, sustainable life coverage can help policyholders plan for a secure financial future.

Designing a Sustainable Life Coverage Policy

When it comes to designing a sustainable life coverage policy, there are essential components that need to be considered to ensure long-term benefits. Customizing a policy to fit individual needs and preferences is crucial in providing the right level of coverage.

Selecting the correct coverage amount and duration is also key in maximizing the benefits of the policy.

Essential Components of a Sustainable Life Coverage Policy

- Clear and Comprehensive Coverage Details: Ensure that the policy clearly Artikels what is covered and what is not, including any exclusions or limitations.

- Flexible Premium Payment Options: Look for policies that offer flexibility in premium payment terms to accommodate varying financial situations.

- Guaranteed Renewability: Opt for a policy that guarantees the ability to renew coverage without the need for additional medical underwriting.

- Living Benefits: Consider policies that offer living benefits, such as accelerated death benefits or cash value accumulation, to provide additional financial support during life.

Tips for Customizing a Policy

- Assess Your Needs: Evaluate your financial obligations, dependents, and long-term goals to determine the appropriate coverage amount.

- Consider Riders: Explore additional policy riders that can enhance your coverage, such as critical illness or disability riders.

- Review Periodically: Regularly review your policy to ensure it still aligns with your current financial situation and needs.

Choosing the Right Coverage Amount and Duration

- Calculate Financial Needs: Consider factors like income replacement, debt repayment, education funds, and final expenses when determining the coverage amount.

- Assess Long-Term Goals: Factor in long-term financial goals, such as retirement savings or legacy planning, when selecting the duration of the policy.

- Seek Professional Advice: Consult with a financial advisor or insurance agent to help you navigate the process and make informed decisions.

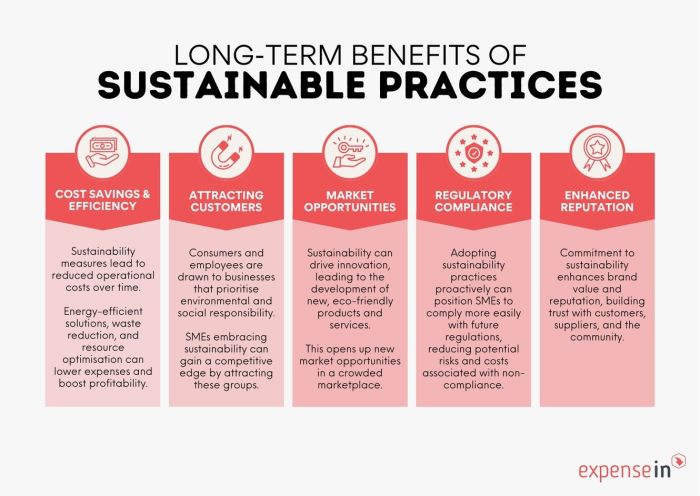

Sustainable Practices in the Insurance Industry

Insurance companies play a crucial role in promoting sustainability through their policies and practices. By integrating sustainable principles into their operations, these companies not only contribute to environmental and social well-being but also support long-term benefits for policyholders.

Role of Sustainable Investments

- Insurance companies are increasingly investing in sustainable projects and companies that prioritize environmental and social responsibility.

- These sustainable investments not only generate financial returns but also contribute to a more sustainable future by supporting renewable energy, conservation efforts, and social impact initiatives.

- By aligning their investment portfolios with sustainable practices, insurance companies can create a positive impact on the environment and society while ensuring long-term financial stability for policyholders.

Contribution of Sustainable Life Coverage

- Sustainable life coverage policies often include benefits that promote a greener and more ethical insurance industry.

- Policyholders of sustainable life coverage may have access to wellness programs, renewable energy incentives, and other environmentally friendly initiatives.

- By choosing sustainable life coverage, individuals can support companies that prioritize sustainability and contribute to a more sustainable future for themselves and future generations.

Final Conclusion

In conclusion, Sustainable Life Coverage with Long-Term Benefits offers not only financial security but also a sustainable approach to insurance. It's a vital tool for individuals looking to secure their future while contributing to a greener and more ethical insurance industry.

Essential FAQs

What does sustainable life coverage mean?

Sustainable life coverage refers to insurance policies that provide long-term benefits while considering environmental and ethical factors in their design.

How can sustainable life coverage support long-term financial goals?

By offering stable and reliable coverage over an extended period, sustainable life coverage ensures that policyholders can achieve their financial objectives without worrying about coverage gaps.

What are the essential components of a sustainable life coverage policy?

The key components include long-term benefits, sustainability considerations, and customizable features to meet individual needs.

How do insurance companies promote sustainability through their policies?

Insurance companies promote sustainability by investing in environmentally friendly projects, offering green insurance options, and adhering to ethical business practices.