Embark on a journey towards better health and reduced insurance costs with our guide on Smart Ways to Stay Healthy While Lowering Insurance Premiums. Discover how simple lifestyle changes can have a significant impact on your insurance premiums.

Learn about the benefits of healthy living, the types of insurance policies that offer incentives, wellness programs, preventive healthcare measures, fitness and nutrition tips, and the importance of mental well-being in relation to insurance costs.

Benefits of a Healthy Lifestyle

Maintaining a healthy lifestyle not only benefits your overall well-being but can also have a positive impact on your insurance premiums. Insurance companies often consider healthy individuals as lower risk, leading to potential cost savings on your insurance policies.

Healthy Habits for Lower Insurance Costs

- Regular Exercise: Engaging in physical activity can reduce the risk of chronic conditions, leading to lower insurance premiums.

- Healthy Diet: Eating nutritious foods can help maintain a healthy weight and prevent health issues, potentially lowering insurance expenses.

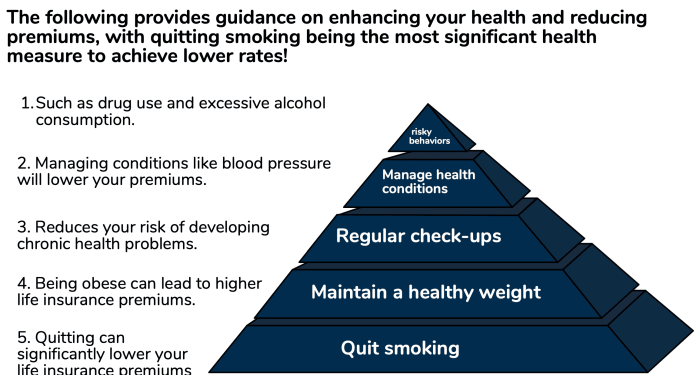

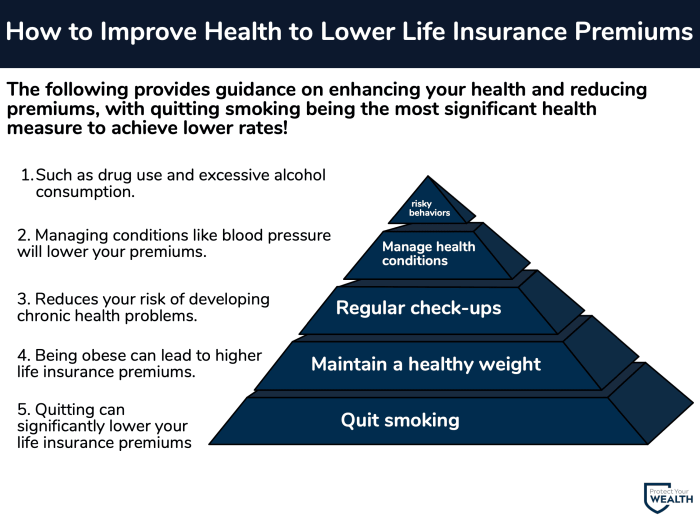

- Non-Smoking: Avoiding tobacco products can significantly reduce the risk of various health problems, resulting in decreased insurance costs.

Correlation Between Health Practices and Reduced Expenses

By adopting healthy habits such as regular exercise, a balanced diet, and avoiding harmful substances like tobacco, individuals can improve their overall health. This, in turn, can lead to fewer medical expenses and a lower likelihood of filing insurance claims.

As a result, insurance companies may offer lower premiums to individuals who demonstrate a commitment to maintaining good health.

Types of Insurance Policies

Insurance policies can vary widely in terms of coverage and benefits. When it comes to incentivizing healthy living, there are specific types of insurance policies that offer rewards for policyholders who maintain good health. These incentives can range from premium discounts to cash rewards for meeting certain health goals.

Health Insurance Policies

Health insurance policies are the most common type of insurance that offer incentives for healthy living. Many health insurance providers offer wellness programs that reward policyholders for engaging in healthy behaviors such as exercise, maintaining a healthy weight, and quitting smoking.

These programs may offer premium discounts, cash rewards, or other incentives for meeting specific health goals.

Life Insurance Policies

Some life insurance policies also offer incentives for policyholders who lead healthy lifestyles. Policyholders who undergo regular health screenings, maintain a healthy weight, and engage in other healthy behaviors may be eligible for lower premiums or other benefits. In some cases, policyholders may even receive cash rewards for meeting certain health goals.

Auto Insurance Policies

While not directly related to health, some auto insurance policies offer incentives for policyholders who lead healthy lifestyles. For example, some auto insurance providers offer discounts for policyholders who do not smoke or who have a clean bill of health.

These discounts may be small, but they can add up over time and provide an additional incentive to maintain good health.

Disability Insurance Policies

Disability insurance policies may also offer incentives for healthy living. Policyholders who maintain good health and engage in healthy behaviors may be less likely to need disability benefits in the future. As a result, some disability insurance providers offer lower premiums or other benefits to policyholders who demonstrate a commitment to maintaining their health.

Wellness Programs and Incentives

Insurance companies often offer various wellness programs to encourage policyholders to adopt healthy behaviors. These programs aim to promote overall well-being and prevent health issues, ultimately leading to lower insurance premiums.

Wellness Programs Offered

- Health Risk Assessments: Insurance providers may offer health risk assessments to help individuals identify potential health risks and take proactive measures to address them.

- Wellness Workshops: Some companies conduct workshops on nutrition, fitness, stress management, and other health-related topics to educate policyholders on healthy living.

- Fitness Challenges: Insurance companies may organize fitness challenges or competitions to motivate individuals to stay active and maintain a healthy lifestyle.

Incentives for Policyholders

- Discounts on Premiums: Policyholders who participate in wellness programs and achieve health goals may be eligible for discounts on their insurance premiums.

- Rewards Points: Some insurers offer rewards points that can be redeemed for gifts or premium discounts when policyholders engage in wellness activities regularly.

- Cash Back Incentives: Certain insurance providers offer cash back incentives for policyholders who demonstrate a commitment to healthy living by completing wellness challenges.

Comparison of Insurance Providers' Approaches

- Company A: Company A focuses on personalized wellness plans tailored to individual policyholders' needs, offering discounts based on health outcomes.

- Company B: Company B emphasizes group wellness activities, such as team challenges and workshops, with rewards points for participation.

- Company C: Company C provides cash incentives for policyholders who achieve specific health goals, encouraging sustained healthy behaviors.

Preventive Healthcare Measures

Preventive healthcare measures play a crucial role in lowering insurance premiums by focusing on early detection and prevention of potential health issues. By proactively managing your health through regular screenings and check-ups, you can reduce the risk of developing serious conditions that may require costly medical treatments in the future

Key Preventive Screenings and Check-ups

- Annual physical exams: Regular check-ups with your primary care physician can help monitor your overall health and catch any potential issues early on.

- Cholesterol screenings: Checking your cholesterol levels can help assess your risk of heart disease and guide lifestyle changes or treatments to lower cholesterol.

- Blood pressure checks: Monitoring your blood pressure regularly can help identify hypertension and reduce the risk of heart disease, stroke, and other complications.

- Colonoscopies: Recommended for adults over a certain age, colonoscopies can detect colorectal cancer early when it is most treatable.

- Mammograms and Pap smears: Essential screenings for women to detect breast and cervical cancer early, increasing the chances of successful treatment.

Importance of Early Detection and Prevention

Regular preventive screenings and check-ups not only help in early detection of potential health issues but also enable timely interventions to prevent the progression of diseases. By addressing health concerns proactively, individuals can avoid more costly medical treatments that may arise from untreated conditions.

Investing in preventive healthcare measures can lead to significant savings on healthcare expenses in the long run, ultimately resulting in lower insurance premiums.

Fitness and Nutrition Tips

Maintaining a healthy lifestyle through proper fitness and nutrition is key to improving overall health and lowering insurance premiums. By incorporating regular exercise and healthy eating habits into your daily routine, you can reduce the risk of chronic diseases and lead a more balanced life.

Fitness Routines

- Start with a mix of cardio and strength training exercises to improve endurance and build muscle.

- Include activities like walking, jogging, cycling, yoga, or weightlifting to keep your body active and strong.

- Set realistic fitness goals and track your progress to stay motivated and maintain consistency.

Nutritious Meal Plans

- Focus on incorporating a variety of fruits, vegetables, whole grains, lean proteins, and healthy fats into your meals.

- Avoid processed foods, sugary drinks, and excessive salt intake to reduce the risk of heart disease, diabetes, and obesity.

- Plan your meals in advance, cook at home more often, and practice portion control to manage your calorie intake effectively.

Mental Health and Well-being

When it comes to overall well-being and insurance premiums, mental health plays a crucial role. Taking care of your mental health not only improves your quality of life but can also lead to lower healthcare costs and insurance premiums.

Impact of Stress Management and Mindfulness Practices

Effective stress management techniques and mindfulness practices can have a significant impact on reducing healthcare expenses. Chronic stress can contribute to various health issues, from heart disease to mental health disorders, all of which can increase insurance costs. By incorporating stress-reducing activities such as meditation, yoga, or deep breathing exercises into your daily routine, you can mitigate these risks and potentially lower your insurance premiums.

Resources and Strategies for Improving Mental Health

- Seek professional help: Consider therapy or counseling to address any mental health concerns.

- Stay connected: Maintain strong relationships with friends and family for emotional support.

- Practice self-care: Engage in activities that bring you joy and relaxation, such as hobbies or exercise.

- Educate yourself: Learn about mental health and mindfulness practices through books, online resources, or workshops.

- Take breaks: Prioritize rest and relaxation to prevent burnout and maintain mental well-being.

Summary

As you navigate the realm of health and insurance, remember that small changes can lead to big rewards. By prioritizing your well-being and adopting smart strategies, you can not only improve your health but also lower your insurance premiums for a brighter and healthier future.

Commonly Asked Questions

How can maintaining a healthy lifestyle impact insurance premiums?

Maintaining a healthy lifestyle can lead to lower insurance premiums as insurers often offer discounts to individuals who demonstrate healthy habits.

What are some examples of healthy habits that can lower insurance costs?

Examples include regular exercise, balanced diet, avoiding tobacco, and staying up to date on preventive screenings.

Do insurance policies offer incentives for engaging in wellness programs?

Yes, many insurance policies provide incentives such as premium discounts, cash rewards, or gym memberships for participating in wellness programs.

How can preventive healthcare measures impact insurance premiums?

Preventive healthcare measures can lead to lower insurance premiums by reducing the risk of costly medical treatments through early detection and prevention.

What role does mental health play in relation to insurance costs?

Mental health is crucial for overall well-being and can impact insurance premiums. Stress management and mindfulness practices can help reduce healthcare expenses.