Exploring the realm of Low-Risk Lifestyle Choices and Coverage Benefits, this article delves into the advantages of making conscious decisions that can impact both health and financial security. As we navigate through the intricacies of lifestyle choices and insurance benefits, a clearer picture emerges of how these factors intertwine to shape our overall well-being.

Low-Risk Lifestyle Choices

When it comes to lifestyle choices, opting for low-risk options can have a significant impact on overall well-being and quality of life. These choices involve behaviors that minimize the chances of negative consequences and promote health and safety.

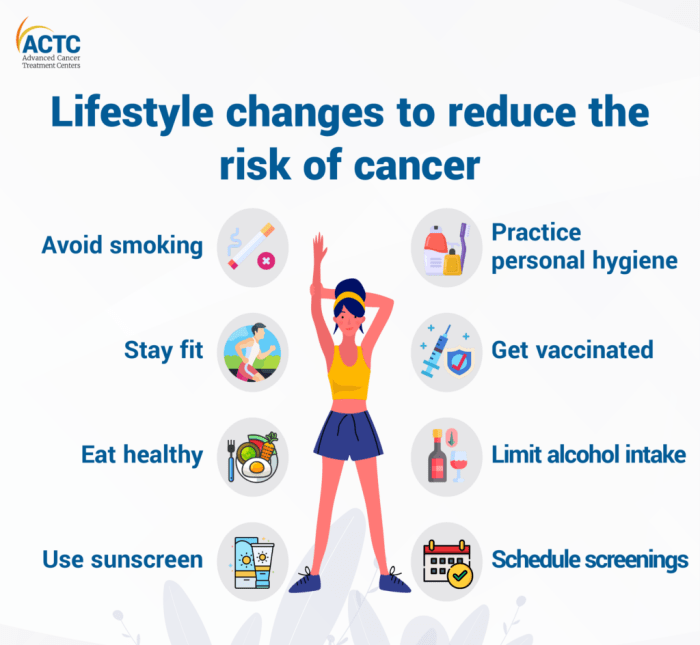

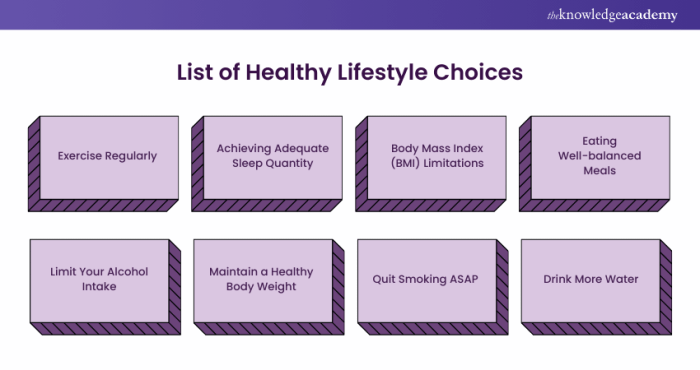

Examples of Low-Risk Lifestyle Choices

- Maintaining a balanced diet with plenty of fruits and vegetables

- Engaging in regular physical activity

- Avoiding smoking and excessive alcohol consumption

- Getting enough sleep and managing stress levels

Benefits of Adopting Low-Risk Lifestyle Choices

By incorporating low-risk lifestyle choices into daily routines, individuals can experience a wide range of benefits, including:

- Improved overall health and well-being

- Reduced risk of chronic diseases such as heart disease, diabetes, and cancer

- Enhanced mental health and cognitive function

- Increased longevity and quality of life

Comparison with High-Risk Lifestyle Choices

When comparing low-risk lifestyle choices with high-risk ones, the differences in outcomes become evident. High-risk behaviors, such as a sedentary lifestyle, poor dietary habits, smoking, and excessive alcohol consumption, are associated with a higher likelihood of health problems and decreased life expectancy.

Coverage Benefits

When it comes to lifestyle choices and insurance coverage, there are various benefits that individuals can enjoy based on their low-risk behaviors. These coverage benefits not only provide financial security but also promote healthy living by incentivizing positive lifestyle choices.

Health Insurance Benefits

- Preventive Care Coverage: Health insurance plans often cover preventive services such as annual check-ups, vaccinations, and screenings for individuals with low-risk lifestyles. This encourages individuals to prioritize their health and detect any potential issues early on.

- Lower Premiums: Insurance companies may offer lower premiums to individuals who maintain a healthy lifestyle, such as non-smokers, regular exercisers, and those with healthy body mass indexes. This serves as a reward for making low-risk choices.

Life Insurance Benefits

- Lower Rates: Individuals with low-risk lifestyles, such as non-smokers and those with no history of chronic diseases, often qualify for lower life insurance premiums. This financial benefit rewards individuals for maintaining healthy habits.

- Enhanced Coverage: Some life insurance policies offer additional coverage or benefits to individuals who lead low-risk lifestyles, such as higher coverage amounts or additional riders for wellness programs.

Disability Insurance Benefits

- Lower Disability Risk: Individuals with low-risk lifestyles are less likely to experience disabilities due to accidents or health conditions. As a result, they may enjoy lower disability insurance premiums and enhanced coverage options.

- Rehabilitation Support: Disability insurance plans may offer rehabilitation support and services to individuals with low-risk lifestyles to help them recover and return to work more quickly in case of disability.

Preventive Health Measures

Regular check-ups and incorporating preventive health measures are crucial components of maintaining a low-risk lifestyle. By taking proactive steps to prioritize your health, you can reduce the likelihood of developing serious health conditions and enjoy a higher quality of life.

Role of Regular Check-ups

Regular check-ups play a vital role in preventing health issues before they escalate. These appointments allow healthcare providers to monitor your overall health, identify any potential issues early on, and provide guidance on healthy lifestyle choices. By scheduling routine check-ups, you can stay informed about your health status and address any concerns promptly.

Incorporating Preventive Health Measures into Daily Routines

To incorporate preventive health measures into your daily routine, consider the following steps:

- 1. Maintain a balanced diet: Focus on consuming nutritious foods that provide essential vitamins and minerals to support your overall health.

- 2. Stay active: Engage in regular physical activity to boost your immune system, improve cardiovascular health, and maintain a healthy weight.

- 3. Get enough rest: Prioritize sleep to allow your body to recharge and recover, promoting optimal health and well-being.

- 4. Manage stress: Practice stress-reducing techniques such as meditation, yoga, or deep breathing exercises to safeguard your mental and physical health.

- 5. Stay up to date on vaccinations: Ensure you receive recommended vaccines to protect yourself and others from preventable diseases.

By incorporating these preventive health measures into your daily routine, you can take proactive steps towards maintaining a low-risk lifestyle and prioritizing your well-being.

Financial Security

Maintaining a low-risk lifestyle can significantly contribute to financial security by reducing the likelihood of unexpected expenses related to health issues or accidents. This, in turn, allows individuals to allocate their resources more efficiently and effectively towards their financial goals.

Budgeting Strategy for a Low-Risk Lifestyle

Creating a budgeting strategy that aligns with a low-risk lifestyle involves prioritizing savings, emergency funds, and insurance coverage. By setting aside a portion of income for these purposes, individuals can better safeguard themselves against unforeseen financial challenges and have a safety net in place.

- Allocate a percentage of income towards savings and emergency funds to cover unexpected expenses.

- Invest in comprehensive health insurance coverage to mitigate the financial burden of medical treatments.

- Consider purchasing disability insurance to protect against loss of income in case of injury or illness.

- Regularly review and adjust the budget to accommodate changing financial needs and goals.

Long-Term Financial Benefits of a Low-Risk Lifestyle

Maintaining a low-risk lifestyle not only provides immediate financial security but also offers long-term benefits that can positively impact one's financial well-being over time. By avoiding high-risk behaviors and prioritizing preventive health measures, individuals can reduce the likelihood of costly medical treatments and loss of income due to health issues.

- Lower healthcare costs over time due to fewer medical interventions and treatments.

- Potential for lower insurance premiums as a result of a healthier lifestyle and reduced risk factors.

- Increased productivity and earning potential by staying healthy and avoiding time off work due to illness or injury.

- Accumulation of savings and investments for future financial goals and retirement.

Closing Summary

In conclusion, Low-Risk Lifestyle Choices and Coverage Benefits offer a roadmap towards a healthier and more stable future. By understanding the significance of preventive health measures, financial security, and insurance coverage, individuals can make informed decisions that pave the way for a fulfilling life.

Essential Questionnaire

What are some examples of low-risk lifestyle choices?

Low-risk lifestyle choices include regular exercise, balanced diet, avoiding smoking, and moderate alcohol consumption.

How do coverage benefits promote healthy living?

Coverage benefits provide financial security for medical expenses, incentivizing individuals to prioritize preventive health measures and regular check-ups.

Can low-risk lifestyle choices lead to long-term financial benefits?

Absolutely. By adopting low-risk lifestyle choices, individuals can reduce healthcare costs and improve overall financial stability in the long run.