Exploring the intricate relationship between your lifestyle choices and insurance premiums, this article delves into the various factors that can significantly influence the cost of your insurance coverage. From your health habits to driving behavior, discover how every aspect of your lifestyle plays a crucial role in determining the premiums you pay.

Factors that Influence Insurance Premiums

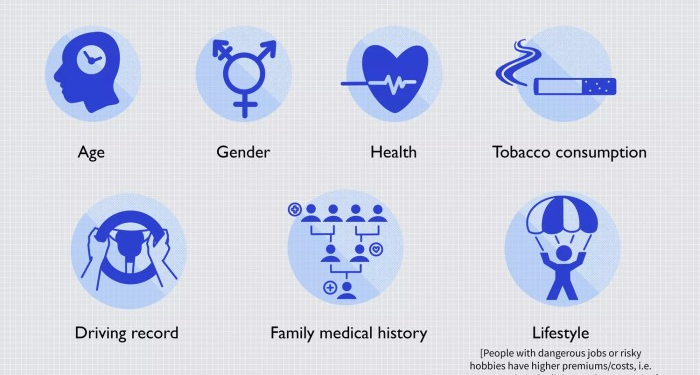

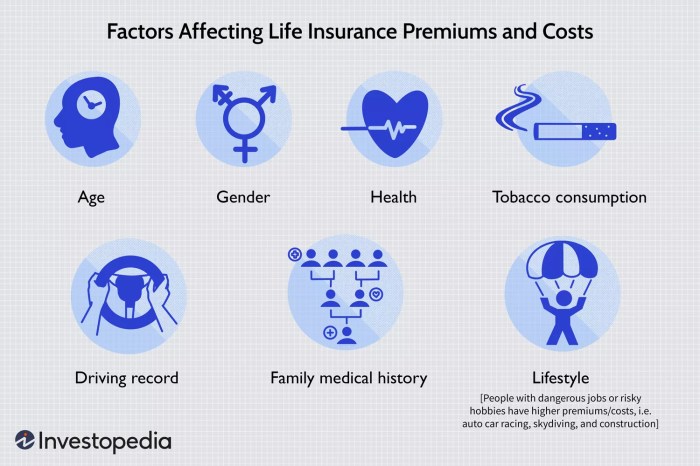

When it comes to determining insurance premiums, there are various lifestyle factors that can have a significant impact on the cost. These factors can range from age and occupation to health habits, hobbies, location, and assets owned.

Age

Age is a crucial factor that insurance companies consider when calculating premiums. Younger individuals typically pay lower premiums as they are perceived to be healthier and at lower risk of health issues. On the other hand, older individuals may face higher premiums due to increased health risks associated with age.

Occupation

The type of occupation a person has can also influence insurance premiums. Jobs that involve higher risk or exposure to hazardous conditions may lead to higher premiums. For example, individuals working in professions like firefighting or construction may face higher insurance costs compared to those in less risky occupations.

Health Habits

Health habits play a significant role in determining insurance premiums. Factors such as smoking, excessive drinking, or unhealthy eating habits can lead to higher premiums due to the increased health risks associated with these behaviors. On the other hand, individuals who maintain a healthy lifestyle may enjoy lower insurance costs.

Hobbies

Engaging in certain hobbies can impact insurance premiums as well. Activities like skydiving, rock climbing, or racing are considered high-risk hobbies, leading to higher insurance premiums. Insurance companies take into account the risks associated with these activities when calculating premiums for individuals who participate in such hobbies.

Location and Assets

Where you live and the assets you own can also influence insurance premiums. Living in areas prone to natural disasters or high crime rates may result in higher premiums for home or auto insurance. Additionally, owning valuable assets like expensive jewelry or a luxury car may increase insurance costs due to the higher replacement value of these items.

Health and Wellness Impact

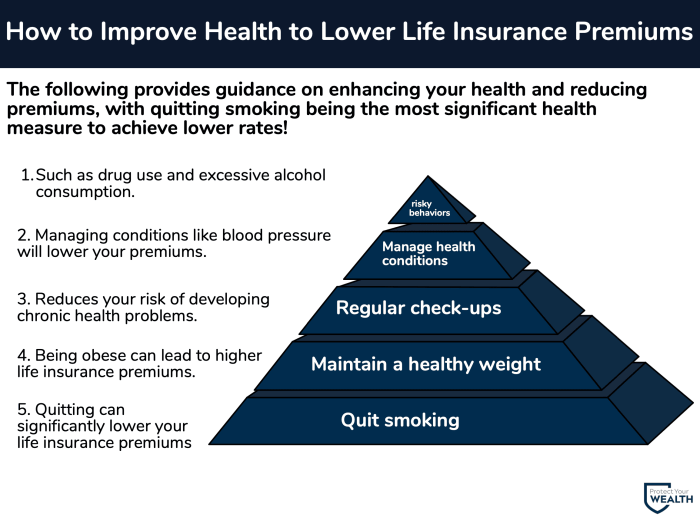

Maintaining a healthy lifestyle not only benefits your well-being but also impacts your insurance premiums. Insurance companies often take into account your health choices when determining the cost of your coverage.

Personal Health Choices and Insurance Premiums

- Healthy Diet: A balanced diet can lower the risk of chronic diseases, leading to lower insurance costs. Insurance providers may offer discounts for policyholders who maintain a healthy weight and eat nutritious foods.

- Regular Exercise: Staying active reduces the likelihood of health issues, such as heart disease and diabetes, resulting in lower insurance premiums. Some insurers incentivize physical activity by offering reduced rates for active individuals.

- Smoking Habits: Tobacco use significantly increases the risk of various health conditions, including cancer and respiratory diseases. Smokers typically face higher insurance premiums due to the elevated health risks associated with smoking.

Correlation Between Health Conditions and Insurance Premiums

- Obesity: Being overweight or obese can lead to medical conditions like diabetes and hypertension, impacting insurance costs. Insurers may charge higher premiums for individuals with obesity-related health issues.

- High Blood Pressure: Hypertension is a common risk factor for heart disease and stroke. Insurance companies may consider elevated blood pressure levels when determining premiums, as it indicates a higher likelihood of future health complications.

Driving Habits and Auto Insurance

Driving habits play a significant role in determining auto insurance premiums. Factors such as your driving record, annual mileage, and the type of vehicle you own can all influence how much you pay for coverage.

Driving Record

Your driving record is one of the most critical factors insurance companies consider when calculating your premiums. A clean record with no traffic violations or accidents typically results in lower insurance costs. On the other hand, multiple traffic violations, accidents, or DUI convictions can lead to significantly higher premiums.

Annual Mileage

The number of miles you drive annually also affects your insurance rates. The more time you spend on the road, the higher your chances of being involved in an accident. Insurance companies may charge lower premiums to individuals who drive less frequently.

Type of Vehicle Owned

The type of vehicle you own can impact your insurance premiums as well. Sports cars and luxury vehicles are generally more expensive to insure due to their higher repair costs and increased risk of theft. On the other hand, safe and reliable vehicles with advanced safety features may qualify for discounts.

Safe Driving Practices and Defensive Driving Courses

Engaging in safe driving practices and completing defensive driving courses can help lower your insurance costs. Insurance companies often offer discounts to drivers who demonstrate responsible behavior on the road and take proactive steps to improve their driving skills.

Impact of Traffic Violations, Accidents, and DUI Convictions

Traffic violations, accidents, and DUI convictions can have a significant impact on your insurance premiums. These incidents signal to insurance companies that you pose a higher risk as a driver, leading to increased rates. It is essential to maintain a clean driving record to keep your insurance costs down.

Home Ownership and Property Insurance

Owning a home comes with various responsibilities, including ensuring that you have the right property insurance coverage to protect your investment. Your lifestyle choices within your home can directly impact the premiums you pay for property insurance. Factors such as home security measures, maintenance routines, and renovations can all play a role in determining your insurance costs.

Impact of Home Security Measures and Maintenance

- Installing security systems, such as alarms and cameras, can reduce the risk of theft and vandalism, leading to potential discounts on your property insurance premiums.

- Maintaining your home regularly, including addressing issues like roof leaks, faulty wiring, or plumbing problems, can prevent larger damages and costly claims, ultimately helping to keep your insurance costs down.

Living in High-Risk Areas

- If your home is located in an area prone to natural disasters like floods, earthquakes, or wildfires, insurance companies may consider it a high-risk property, resulting in higher premiums.

- Consider investing in additional coverage or mitigation measures to protect your home and belongings in case of such events, as this proactive approach can potentially lower your insurance costs.

Benefits of Smart Home Technology

- Integrating smart home technology, such as smart thermostats, water leak detectors, or security systems, can not only enhance the safety and efficiency of your home but also qualify you for insurance discounts.

- Insurance providers often offer incentives for policyholders who use smart devices that reduce the risk of damages or losses, promoting a safer living environment and potentially lowering your insurance premiums.

Epilogue

As we conclude our discussion on how your lifestyle impacts insurance premiums, it becomes evident that the choices you make in your daily life have a direct impact on the costs of your insurance coverage. By understanding these factors and making informed decisions, you can potentially lower your premiums and secure the coverage you need.

FAQs

How does smoking habits affect insurance premiums?

Smoking habits can increase insurance premiums due to the higher health risks associated with smoking.

Can maintaining a healthy lifestyle lead to lower insurance costs?

Yes, maintaining a healthy lifestyle by engaging in regular exercise and a balanced diet can lead to lower insurance premiums.

How does traffic violations impact insurance premiums?

Traffic violations can result in increased insurance premiums as they indicate higher risk behavior on the road.